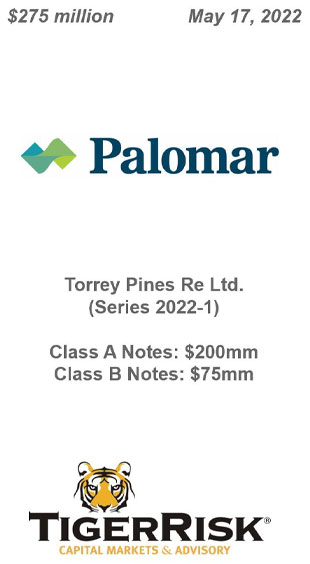

Transaction Overview

On March 12, 2021, Palomar closed another Cat Bond issuance through Torrey Pines Re Ltd.

- 144A Cat Bond issuance

- Class A: $200 million

- Class B: $75 million

- Bermuda-domiciled special-purpose insurer providing reinsurance protection to Palomar

All Notes provide per occurrence, indemnity-triggered event coverage to Palomar

- Exposed to earthquake events throughout the United States

$200mm Class A Tranche: U.S. EQ only

- Expected loss: 1.23% (time dependent)

- Final pricing: 5.00%

$75mm Class B Tranche: U.S. EQ only

- Expected loss: 3.77% (time dependent)

- Final pricing: 8.25%

Transaction successfully closed amidst challenging financial market conditions

TigerRisk Capital Markets & Advisory Role

TCMA is acting as the Joint Structuring Agent and Joint Bookrunner

- Presented innovative structuring ideas and helped to finalize the structures

- Assisted in all aspects of the structuring and placement including, but not limited to:

- Structuring and co-ordination with legal counsel

- Finalizing investor presentation, risk analysis results, and offering documents

- Investor roadshow and marketing processes

- Other various distribution activities